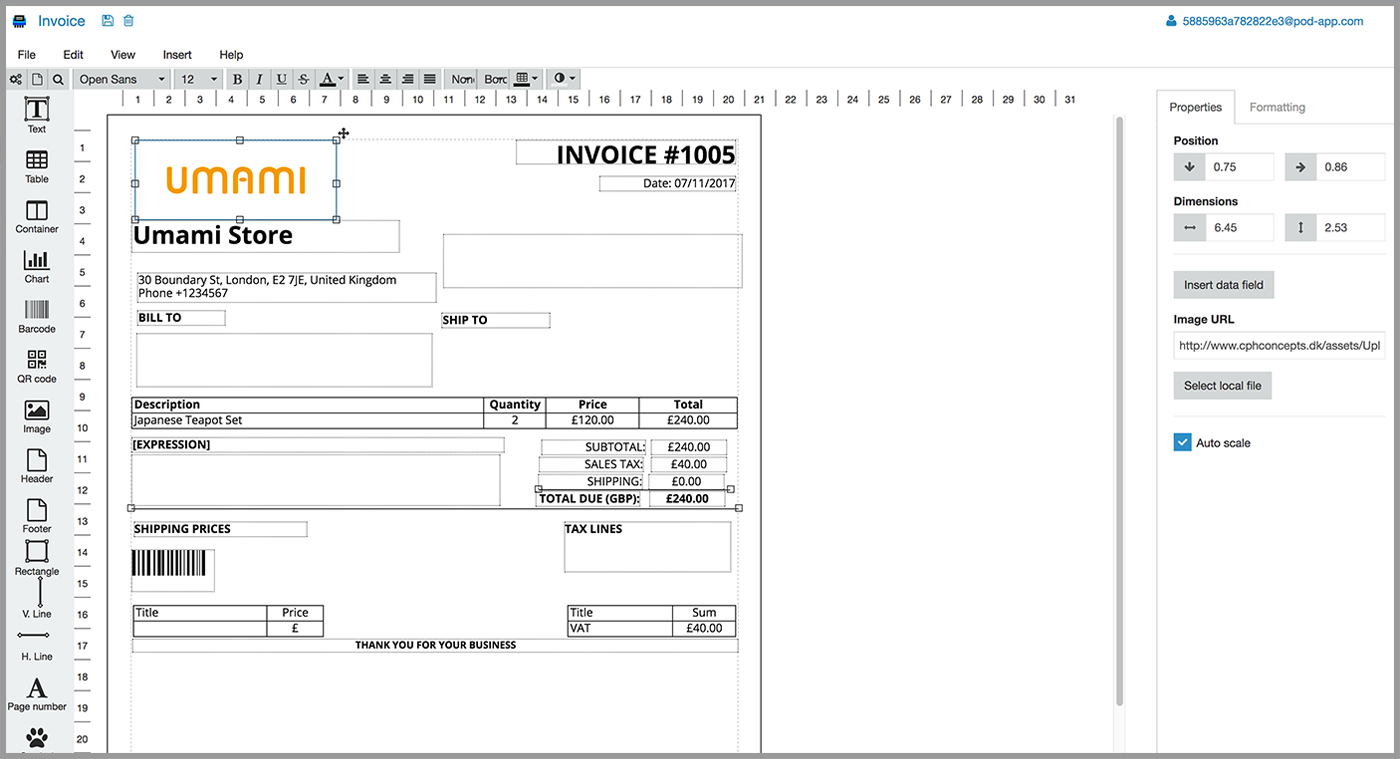

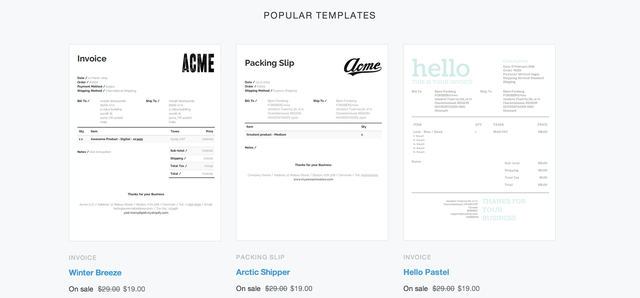

A unique invoice numberĮach invoice should have its own unique number, and your bookkeeping system should keep a record of the numbers used. This is not only for practical reasons, it’s a legal obligation for businesses in most countries. Make it easy to see and impossible to confuse with a different document, like a purchase order or a credit note. Invoice terminologyįirst, make sure you include the word “invoice” at the top of the document. Here are the elements you should keep in mind when creating your invoice template: 1. Your invoice format will depend on your bookkeeping needs, your local regulations, and the type of store you run. You could also receive a purchase order containing the same information from a buyer if they’re making a large order from you. This establishes an approval process in your company and defines the price and scheduled delivery of an order. A purchase order works the other way around it details the items a buyer wants to purchase at a certain price point.Īs a business, you’d issue a purchase order when ordering large product quantities from a supplier. You issue an invoice when you’ve sold a product and want to request a payment. Unlike an invoice, which often has detailed payment terms and other information, a bill is a simple statement of what’s due for payment now. When you issue an invoice, a customer pays you in the days or weeks to follow.Ī bill records a sale that the customer pays right away. billĪn invoice acts as a request for future payment. You may have come across other terms for records of business transactions, including a bill and a purchase order. How invoices differ from bills and purchase orders

#SHOPIFY INVOICING PRO#

💡 PRO TIP: Set reorder points in Shopify admin to get low stock notifications and ensure you have enough lead time to replenish a product’s inventory before quantities reach zero.

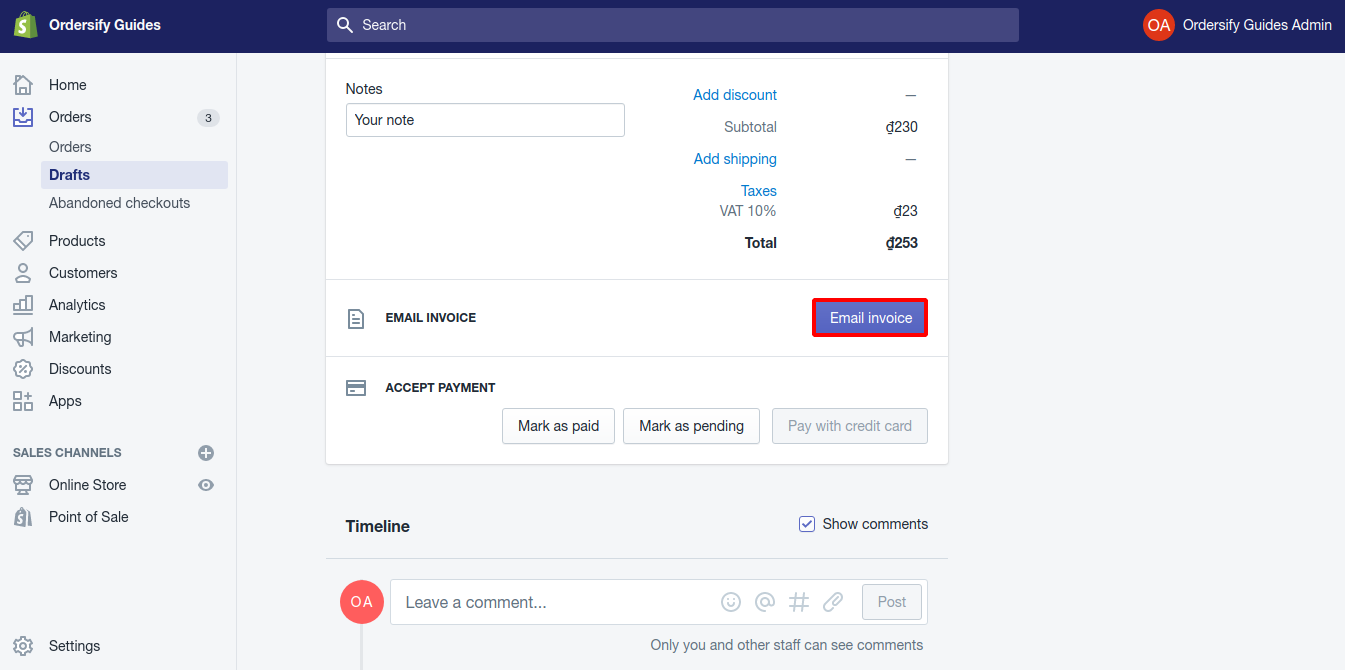

This also means you can track and adjust your inventory to improve cash flow and avoid overstocking or running out of a popular product. When you know what’s coming, you can better prepare your store’s layout, promotions, and staff schedules. When you keep detailed track of the products you sell, you can better forecast demand for your store for specific seasons or based on yearly trends. You need to store the invoices you issue to show the revenue your business earned, as well as the sales tax you collected, based on the state or country of the customer you invoiced. They help you keep track of your store’s revenue for tax purposes, as each invoice is a tax document. Invoices play a vital role in your bookkeeping. This is useful for understanding the impact of your marketing activities on your sales, as well as planning for the next period. Invoices also allow you to track sales, including the exact products and amounts sold, as well as the number of sales you made in a given period. They outline your payment terms (like on receipt or by the end of the month), which helps you predict your cash flow and plan activities and expenses around it. Invoices enable you to get paid-plain and simple. What is the purpose of an invoice? Request timely payment and track sales Products you sold and their individual cost.They’re also practical because they contain all the important information about a sale on a single page: Invoices are the backbone of your cash flow, inventory tracking, and business accounting. It confirms and logs the products a customer bought and the amount they have agreed to pay for those products.

0 kommentar(er)

0 kommentar(er)